nebraska property tax calculator

Real Property Tax Credit non-agland and Agricultural Land Tax Credit for Tax Year 2022. The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called Nebraska Property Tax Credit Click here to learn more about this free subscription.

2022 Property Taxes By State Report Propertyshark

Tax Calculators Tools Tax Calculators Tools.

. States has some of the highest property tax rates. The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000. Counties in Nebraska collect an average of 176 of a propertys assesed fair.

The credit may be claimed by filing an Amended Nebraska Property Tax Incentive Act Credit Computation Form PTCX. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Enter the amount of property taxes you paid in the. For comparison the median home value in Lancaster County is. Resident individuals may claim the credit by filing a Nebraska income tax return for free over the internet using the DORs NebFile system.

Its a progressive system which means that taxpayers who earn more pay higher taxes. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The Federal or IRS Taxes Are Listed.

The Nebraska property tax lookup can be used to calculate your property taxes for the upcoming year. Important note on the salary paycheck calculator. Please note that we can only.

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Nebraska like all US. Nebraskas state income tax system is similar to the federal system.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Driver and Vehicle Records.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For comparison the median home value in Nebraska is. For comparison the median home value in Douglas County is.

There are four tax brackets in. For comparison the median home value in Dodge County is. The state income tax rate in Nebraska is progressive and ranges from 246 to 684 while federal income tax rates range from 10 to 37 depending on your income.

This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Nebraska property tax records tool to get more. The Nebraska Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. File a 2020.

County AssessorDeputy Assessor Examination - November 10 2022. For comparison the median home value in Lincoln County is. Registration Fees and Taxes.

Compared To Rivals Nebraska Takes More From Taxpayers

Property Tax Homestead Exemptions Itep

U S Cities With The Highest Property Taxes

Get The Facts On Responsible Tax Reform Office Of Governor Pete Ricketts

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nh Had Seventh Highest Effective Property Tax Rate In 2021 Report Says Nh Business Review

Feeling The Squeeze The Negative Effects Of Eliminating Nebraska S Inheritance Tax Open Sky Policy Institute

Taxes And Spending In Nebraska

U S Cities With The Highest Property Taxes

Which States Have The Lowest Tax Rates Seniorliving Org

The Reasons Behind Minnesota S National Property Tax Rankings

Nebraska Income Tax Calculator Smartasset

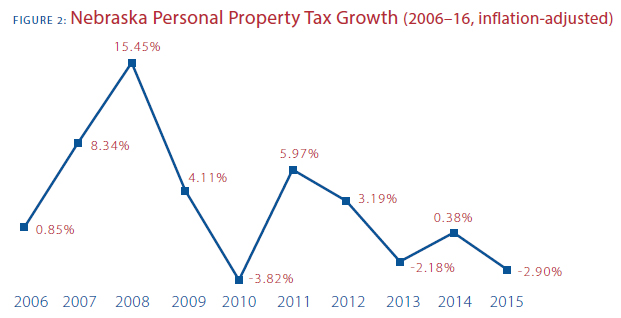

This Time It S Personal Nebraska S Personal Property Tax

Accounting For Agriculture Personal Property Tax Relief Act Cropwatch University Of Nebraska Lincoln

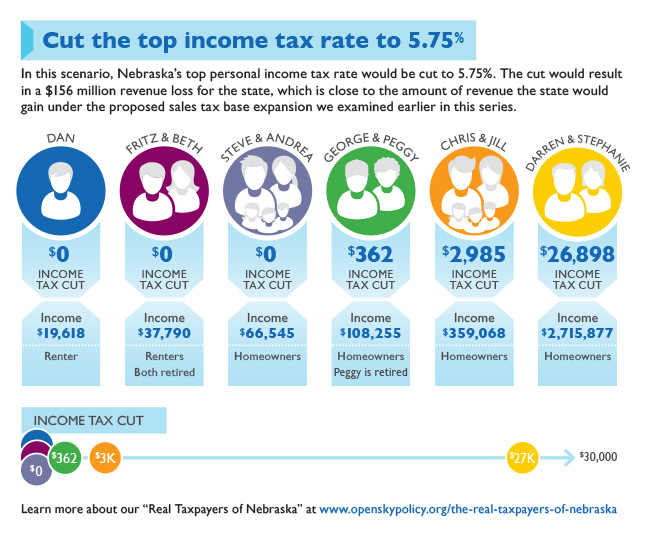

2013 Page 3 Open Sky Policy Institute

Nebraska Real Estate Transfer Taxes An In Depth Guide

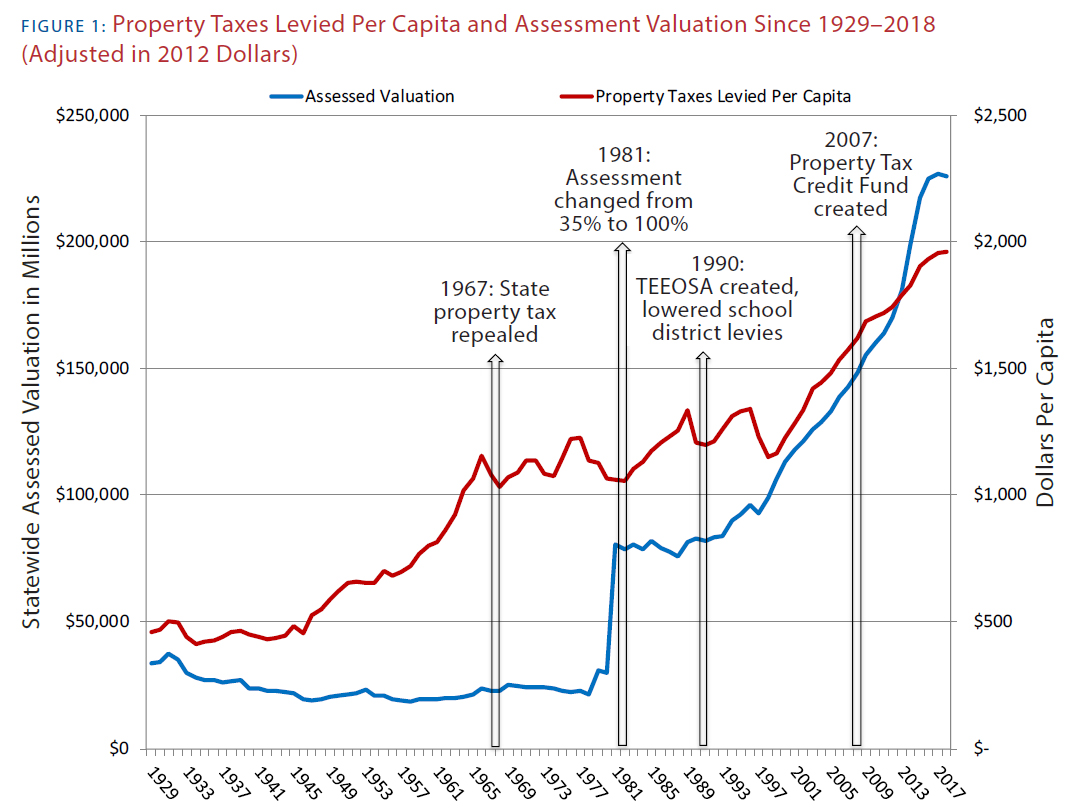

Get Real About Property Taxes 2nd Edition

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan